Florida Amendment 5 2024 Explained

Florida Amendment 5 2024 Explained. As of september 3, 2024, six statewide ballot measures were certified for the ballot in florida in 2024. The aclu of florida is supporting amendments 3 and 4, which, if passed, will significantly impact your freedom and liberty in florida.

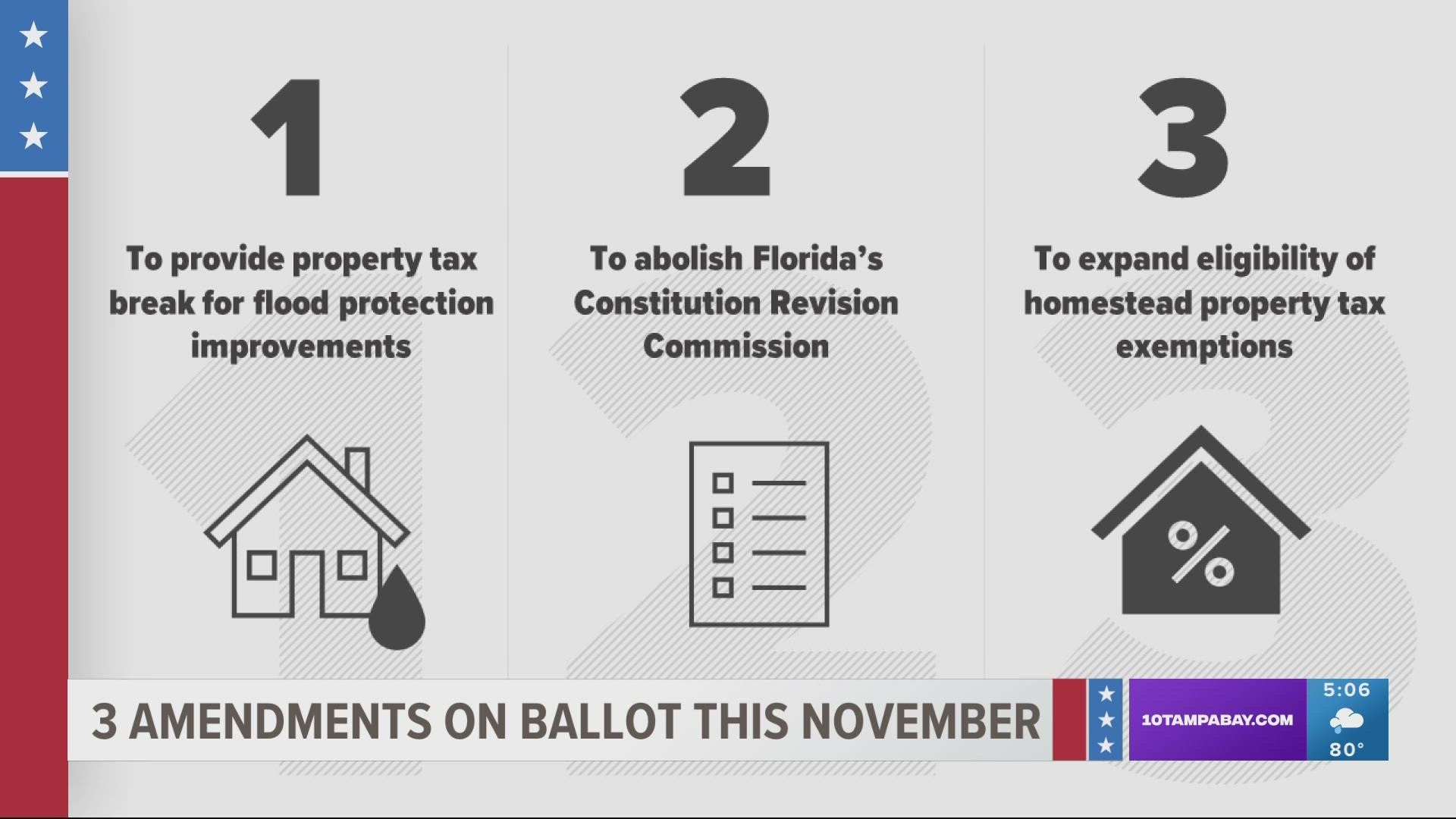

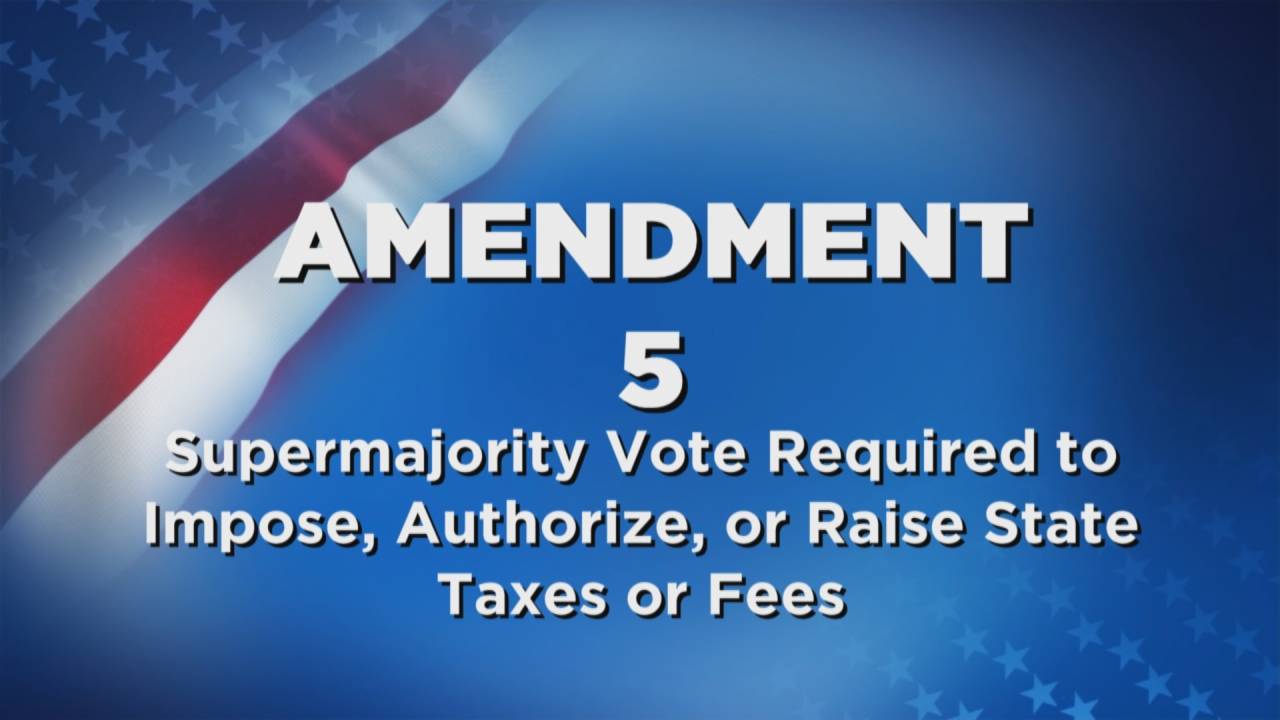

Amendment 5 — homestead annual inflation adjustment. There are six constitutional amendments on the statewide ballot.

Florida Amendment 5 2024 Explained Images References :

Source: www.jamesmadison.org

Source: www.jamesmadison.org

2022 Florida Amendment Guide James Madison Institute, There will be six proposed constitutional amendments on florida’s ballots in november’s general election.

Source: denyseyvalentia.pages.dev

Source: denyseyvalentia.pages.dev

Florida Amendments 2024 Pdf Free Download Dallas Marcelline, 5, 2024, and each amendment must get at least 60% of the vote to pass.

Source: www.wptv.com

Source: www.wptv.com

Understanding Florida constitutional amendments, Partisan election of members of district school boards.

Source: heddiysimonette.pages.dev

Source: heddiysimonette.pages.dev

Florida Constitutional Amendments 2024 Pdf Alyse Delcina, (1) joint resolution by the florida legislature;

Source: zondaymignon.pages.dev

Source: zondaymignon.pages.dev

Florida Amendment 5 2024 Elena Karine, Partisan election of members of district school boards.

Source: www.youtube.com

Source: www.youtube.com

📜 What are the Florida Constitutional amendments 2022 YouTube, People wait in line to vote outside of an early voting site in miami beach, fla.

Source: www.wsfltv.com

Source: www.wsfltv.com

Florida Amendments What to know before you vote, In the 2024 election, florida residents will get the chance to decide.

Source: www.local10.com

Source: www.local10.com

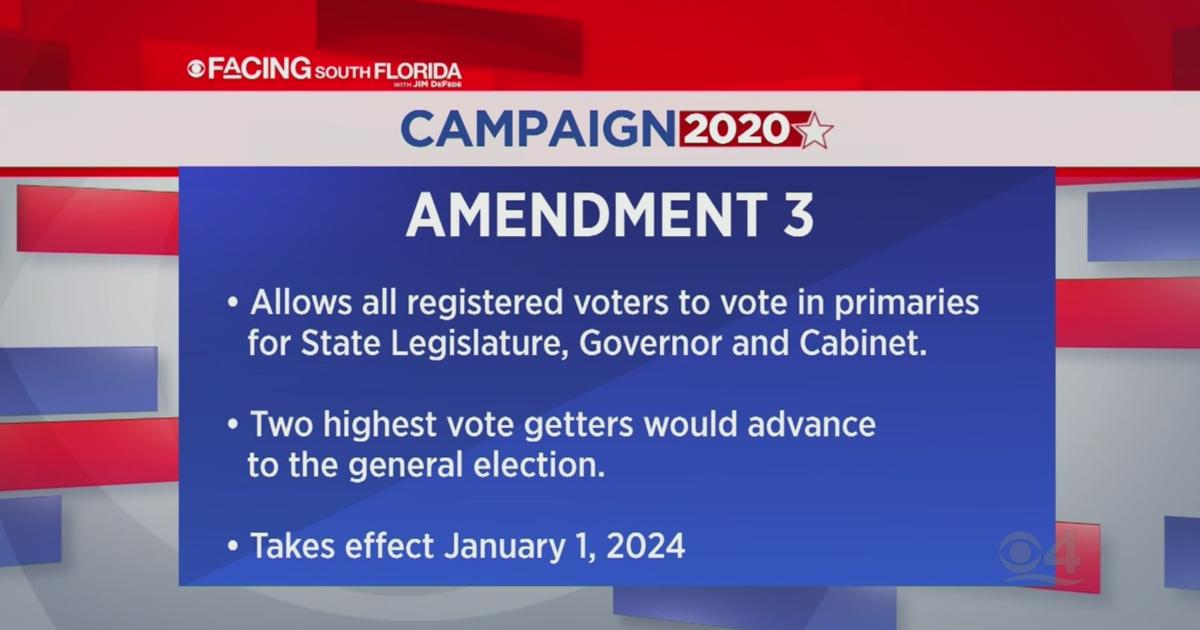

Understanding Florida's constitutional amendment questions on…, Florida amendment 3, the marijuana legalization initiative, is on the ballot in florida as an initiated constitutional amendment on november 5, 2024.

Source: www.reddit.com

Source: www.reddit.com

Florida Abortion Amendment Secures 2024 Ballot Placement r/newswall, 5 elections, here's what readers should know about the constitutional changes in their power:

Source: dreamhomespain.co.uk

Source: dreamhomespain.co.uk

Florida General Election Ballot Constitutional Amendments Explained, Project 2025 would seek to get rid of current tax rates and most deductions and credits, instead proposing a 15% rate for anyone under the social security wage base ($168,000 in 2024) and.

Posted in 2024